For employers across the country, the financial pressure of providing affordable healthcare coverage continues to grow. Rising premiums, unpredictable pharmacy benefit costs, and limited visibility into where dollars are going have created an unsustainable burden.

Those who wait for reform may pay the price – literally and figuratively. Delaying action can mean overpaying for coverage, misallocating resources, and falling behind competitors who have already embraced more modern, transparent benefit solutions.

While the industry waits for reform, Woligo Pharmacy Solutions is already helping connect employers with forward-thinking partners who are aligned with the right principles today, not years from now.

Legacy Systems Are Failing Employers

Many traditional healthcare benefit models are built on outdated systems that no longer serve employers’ best interests.

Pharmacy benefit managers (PBMs) emerged in the 1960s as insurers started incorporating prescription drugs into health insurance coverage as a way to help reduce drug costs and streamline benefits.

Over time, large insurers began acquiring or integrating with PBMs, retail pharmacies, and even healthcare providers. Today, many of the biggest players own all three – insurer, PBM, and pharmacy – creating a closed loop where they profit at multiple points along the healthcare journey.

In 2024, the Federal Trade Commission released a report indicating that six major PBMs control approximately 95% of all prescriptions in the United States. The report found that these companies often overcharge both patients and employers, steering prescriptions to pharmacies they own or to higher-priced drugs that generate larger profits.

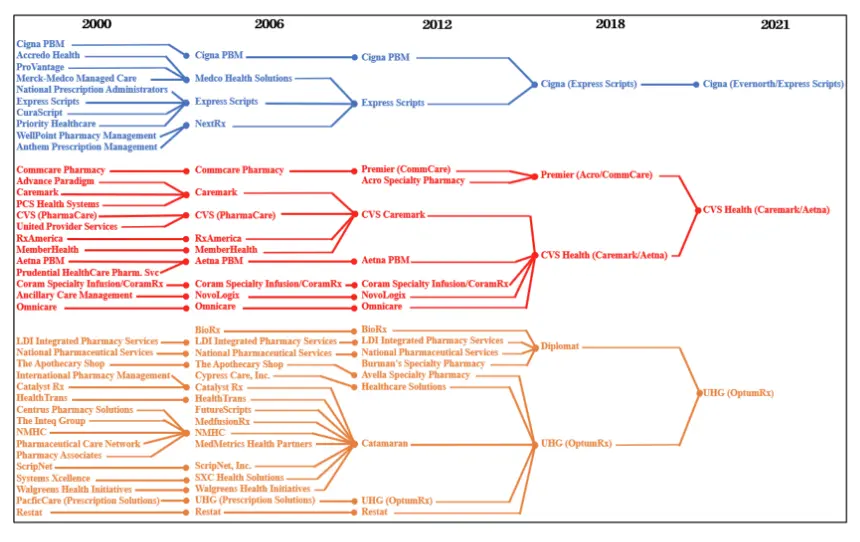

The Arkansas Attorney General diagrammed some of the mergers and acquisitions among the three largest PBM parent entities between 2000 and 2021, as shown below.

Vertical integration has shifted the focus from lowering costs to maximizing profits. Instead of helping employers and patients save, these systems rely on hidden markups, undisclosed rebates, and confusing pricing to make money.

As a result, employers are left in the dark, paying more each year without a clear explanation, while the integrated systems collecting those payments continue to grow more profitable.

Growing Push from Lawmakers

Across the country, lawmakers are turning up the pressure on PBMs and insurers to bring greater transparency and accountability to employer-sponsored health plans. Both federal and state leaders are introducing legislation designed to shine a light on the deceptive practices that have long made it difficult for employers to manage rising healthcare expenses.

At the federal level, bipartisan support has emerged for reforms that would:

- Prohibit a parent company of a PBM or a health insurer from owning a pharmacy business

- Require PBMs to disclose pricing and rebate arrangements

- Ensure employers receive the full value of negotiated rebates and discounts

- Prohibit spread pricing and other hidden markups

- Strengthen reporting requirements around pharmacy and plan costs

State-level reform efforts have also gained traction, with 24 states passing 33 bills in 2024 to regulate PBM practices. This patchwork of state action reflects growing frustration with a system that too often favors intermediaries over employers and employees.

The Cost of Inaction: What It’s Really Costing You

Waiting for government reform won’t solve the immediate problem. Rising healthcare expenses and a lack of transparency in pricing are creating serious challenges for employers. Without clear insight into where costs are coming from, or how they’re managed, many businesses are caught off guard by budget-breaking increases.

Employers are being forced to make hard choices: absorb skyrocketing costs or pass them on to employees. And most are choosing the latter. Four out of five employers plan to raise employee premium contributions by nearly 6% on average, putting even more strain on workers.

Proactive, transparent solutions can help you avoid costly surprises and protect both your bottom line and your people.

Take Control Before It’s Too Late

When employers act on their own terms, they stay in the driver’s seat. Waiting for federal or state mandates means giving up control over the how and when of fixing a broken system.

Making the decision now means you choose your partners, your pace, and your priorities. You can design a plan that aligns with your budget, your workforce, and your values instead of rushing to meet compliance requirements later.

Employers who move early don’t just stay ahead of regulation. They lead with intention, reduce costs sooner, and position their businesses for long-term stability.

Ready to Take Control of Your Pharmacy Costs?

Those who wait for reform may pay the price – literally and figuratively.

Take the first step toward a healthier bottom line and a more predictable, manageable health plan budget.